(Versions in Français and عربي)

Aspirations for greater fairness were at the core of the protests that triggered the Arab Spring almost five years ago—and remain largely unfulfilled today. In our new paper, we show that tax reform can go a long way towards meeting those aspirations.

Taxation is a critical interface between the state and citizens. How much revenue is raised, how the tax burden is distributed, and how taxation is implemented can all powerfully affect both the reality and the perception of economic opportunities—and the degree of trust in government.

Tax systems vary greatly across the countries of Middle East and North Africa: some have diverse and developed tax systems (oil importers and Algeria, Iran, and Yemen); in others, tax revenues come mostly from oil (essentially oil exporters). In both cases, however, there is a lot of room to improve fairness for both individuals and business through taxation.

Tax design: A conduit for greater fairness in diversified tax systems

In many of these countries tax systems are well established but their application is often arbitrary, and tailored to benefit the privileged.

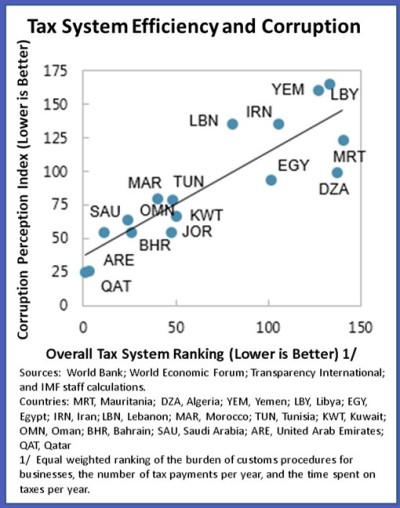

For example, the highest personal income tax rate is often low and applied to incomes so high that almost no one is affected; as a result, the wealthy may not pay their fair share, relative to the burden shouldered by the middle class. Corporations face tax rates comparable to those in other regions, but in many countries privileged companies are let off the hook through non-transparent and often arbitrarily applied exemptions. Value-added taxes (VATs) also suffer from exemptions, with the additional complication of a multiplicity of rates. Finally, burdensome tax administration is associated with unfair treatment of citizens and businesses (Chart 1).

What can be done? Key changes in the design of tax systems can make a big difference—improving fairness, creating a more level playing field for businesses, and reducing opportunities for arbitrary application of tax laws. Our paper proposes to:

- Simplify tax structures by consolidating multiple VAT rates and reducing the number of tax rates paid by corporations.

- Widen the base on which taxes are collected by eliminating corporate income tax exemptions, and reducing and better targeting those for VAT.

- Increase progressivity of personal income taxes, with three-to-four tax rates that rise with income, and apply to all income types (e.g. not only salaries but also investment income) so rich households pay their fair share.

- Introduce or better design and enforce taxes on real property.

- Make tax and customs administration more user-friendly by improving “customer service” and simplifying codes and regulations.

Starting off on the right foot: Creating a fair tax system in countries dependant on oil revenues

Oil exporting countries, dependent on revenues from oil, have not had much need to introduce other taxes. But the possibility of persistently low oil prices is changing this perspective, as many countries have already lost their ability to coast along on a cushion of oil revenues. Broadening the tax system would be important not only to raise revenues, but also to support longer-term economic diversification.

These countries could begin gradually with a “starter pack” comprising a low-rate VAT, profit taxes applied to all resident companies, excises, and property taxes. Simultaneously, they could build administrative capacity and taxation expertise. And, as a key building block towards fairness in any modern tax system, they could start planning for a broad-based and effective personal income tax.

It’s going to take political will

All this may sound easy in theory, but the reality is that there will be much resistance to these reforms. Policymakers, across the Middle East and North Africa, will have to tackle vested interests, build broad-based support, and reform tax administrations that may have little appetite for change. Effective communication, transparency, and a constructive dialogue between the state and citizens will be critical to the success of tax reform.