China is moving toward a “new normal” of safer and more sustainable growth. To this end, ensuring its labor market stays resilient will be critical. Reforms to contain vulnerabilities caused by buildup of credits may temporarily slow growth, and raise the unemployment rate, but supported through a strong safety net, these reforms will raise productivity, and facilitate more sustainable growth.

Despite the slowdown of the past few years, however, China’s labor market has remained resilient. Efforts to maintain labor market stability are paying off, helped by an expanding services sector.

Labor market conditions are holding up fairly well

Although high-frequency employment indicators in the purchasing managers’ indices (PMI) showed signs of softening up to August 2015, labor market conditions appear to have held up well in the broader context, even as the economy slowed.

Newly-created urban jobs reached 13.6 million in 2014, and the first half of 2015 saw an additional 7.1 million new urban jobs created—on track to reach the government’s official target of 10 million new jobs for the year (Chart 1).

While wage growth has been slowing, it remains about 8 percent in the first half of this year, largely in line with nominal GDP growth. And migrant and urban workers have been enjoying similar gains, while the official registered unemployment rate held steady at about 4 percent, as did the surveyed unemployment rate (at about 5.0-5.1 percent).

What has contributed to this resilience?

In the recent IMF working paper, China’s Labor Market in the “New Normal”, we find that long-term trends, such as urbanization, tend to support employment growth.

The expanding services sector is a key factor. It is usually more labor-intensive than other sectors, creating jobs for people from rural areas. Indeed, the sector accounted for close to 40 percent of the labor force and contributed to 48 percent of value-added in 2014, surpassing manufacturing. Less surplus labor from demographic changes such as labor force growth also reduces the pressures on employment.

At the same time, unique features in China’s labor market warrant special attention. Among these, the first two—migrant flows (that is, rural labor moving to urban centers), and continued and potentially increasing surplus labor, especially in large state-owned enterprises (SOEs)—might serve as buffers during economic slowdown, even though they also raise concern. The third, data shortcomings, simply makes an assessment of labor market conditions more challenging.

- Rural–urban migrant flows are generally not fully reflected in unemployment data, but might have acted as a shock absorber. Migrant jobs, largely in low-skill industries, are usually more vulnerable to slower growth, while our empirical analysis shows that migrant flows are largely driven by growth, and the urban-rural income gap. They are key to understanding labor market dynamics in China. In fact, migrant flows grew more slowly in 2014 (year-over-year), in line with the growth slowdown (Chart 2). While this phenomenon contributes to labor market stability in the short term, if it persists, it may delay the transformation of the economy and corresponding increases in productivity and income levels.

- State-owned enterprises (SOEs) are keeping workers formally employed, despite overcapacity, and weakening profitability, particularly in provinces that rely on heavy industries. While this can temporarily shield the labor market against shock, it could also weaken labor flexibility in the medium term, and hence the needed adjustment of the economy. The recent SOE reforms that envisages exits of nonviable SOEs, and which provides sufficient social safety nets, could facilitate labor market adjustments over the medium term.

- Labor market data shortcomings make accurate, up-to-date assessment of labor market conditions difficult. Labor market data in China are known to be far from ideal. Key data series are available, but their coverage, frequency, and timeliness have significant limitations. Given the increasingly important role of labor market statistics for policymaking, their strengthening will be paramount, and the government is taking steps to improve them by expanding the coverage of surveyed unemployment to include all cities.

Continued reforms are key to resilience going forward

It is true that implementing reforms will likely slow near-term growth further. But will it pose risks to the labor market? Our analysis gives a clue. We think the risk is modest and would be worth taking.

Our analysis suggests that, with steadfast reform implementation and medium‑term growth staying around 6–6½ percent, net urban employment could stay near 10 million per year—meeting the government’s current policy target.

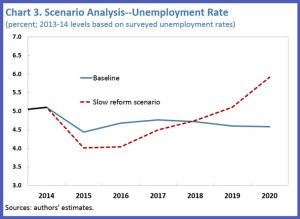

To be sure, stepped-up SOE reforms and adjustment in sectors with overcapacity would, in the near term, release excess labor, and push up the unemployment rate. However, this would facilitate structural transformation—including service sector expansion, and new investment in productive enterprise—toward a more sustainable growth path (Chart 3). Instead of maintaining employment levels in these industries, well-targeted, on-budget support to affected employees would facilitate the transformation while providing an effective social safety net.

In contrast, as highlighted in the 2015 IMF report on China, delays in reform implementation would build up vulnerabilities, weaken long-term economic prospects, and potentially worsen unemployment over the medium term.

The tradeoff is therefore obvious. Continuing reforms to a sustainable growth path are key to maintaining labor market resilience.